38

Wisconsin Community Banker

January/February 2014

PEOPLE

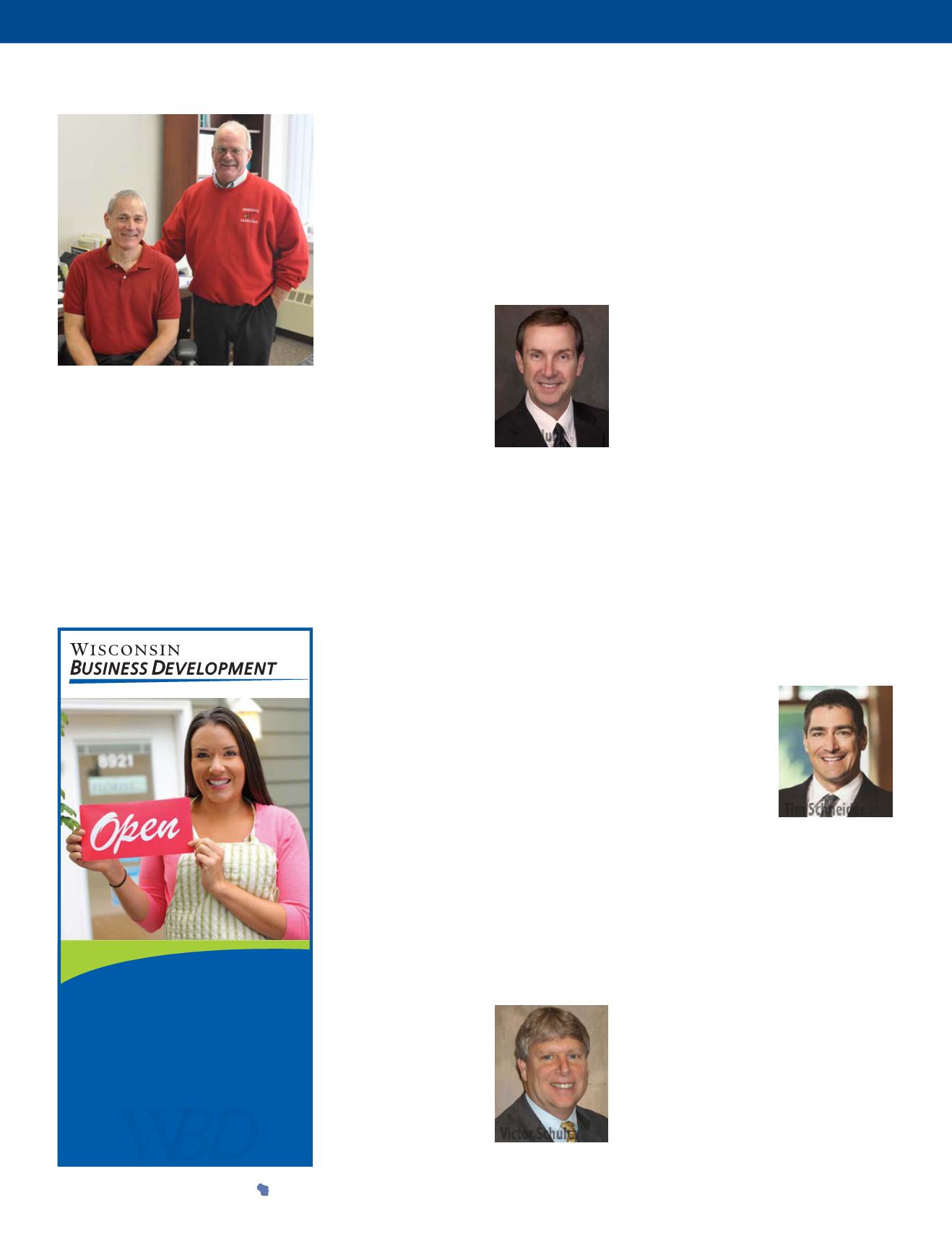

Changes at Bank of

Brodhead

Tom Fenwick (standing) retired

on Dec. 31 from his position of vice

president for ag lending at the Bank

of Brodhead. He will continue to

serve on the board of directors. Glenn

Marass, who is succeeding Fenwick,

comes to the bank with 35 years of

experience as an ag loan officer.

Blom Promoted

LITTLE CHUTE—BLC Community

Bank has named Linda Blom vice

president. She has been with the bank

since 1978.

Waterstone Mortgage

Names Selingo SVP

PEWAUKEE—Waterstone Mortgage,

a division of WaterStone Bank, named

Bob Selingo as senior vice president,

secondary marketing.

Holum Hired

CROSS PLAINS—The State Bank of

Cross Plains has hired Dan Holum as

vice president – resi-

dential lending. With

30 years of residen-

tial mortgage experi-

ence, Holum serves

on the board of the

Madison Chapter

of the Wisconsin

Mortgage Bankers Association and is

a member of the Realtors Association

of South Central Wisconsin.

Eddingsaas Promoted to

Controller at Spring Bank

BROOKFIELD—Spring Bank pro-

moted Leann Eddingsaas to controller

and bank officer.

Hoepfner Joins

Foundations as SVP

PEWAUKEE—Bob Hoepfner has

joined Foundations Bank as senior

vice president and head of lending.

Gainer Joins Home

Savings Bank

MADISON—Home Savings Bank has

hired Dana Gainer as the vice presi-

dent of retail banking. Gainer joins the

bank with over 20 years of banking

experience.

Schultz Joins Prairie

Financial Group®

WAUKESHA—Prairie Financial

Group®, a division of Waukesha State

Bank, has appointed

Victor Schultz to the

newly created posi-

tion of senior vice

president and head

of personal trust.

Recently, Schultz

played a role in

Wisconsin adopting the Uniform Trust

Code (UTC), signed into law by Gover-

nor Scott Walker on Dec. 13, 2013. The

legislation follows a seven-year effort

during which Schultz acted as co-chair

of the Trust Code Study group charged

with drafting the bill. The passage

makes Wisconsin the 29th jurisdiction

to adopt the UTC, and coincides with

the increased use of trusts for estate

planning and commercial transactions.

The UTC provides a comprehensive

codification of the default rules that

pertains to trusts.

Schultz earned his juris doctor-

ate from Marquette University Law

School and a bachelor of business

administration from the University

of Wisconsin-Madison. Previously,

Schultz was vice president and U. S.

estate planning specialist for BMO

Private Bank.

Waukesha State Bank created Prai-

rie Financial Group® nearly 40 years

ago and it has grown to serve clients

throughout the United States. Its

clients include individuals, businesses,

non-profits and academic institutions.

For more information, visit www.

PrairieWealth.com.

Schneider Appointed CEO

MANITOWOC—Investors Com-

munity Bank has appointed Timothy

Schneider as CEO.

He had served as

interim co-CEO

since November

2011.

“Tim [is] a

strong leader with

outstanding com-

munity banking experience, who

has been an integral member of the

co-founding team of our very success-

ful community bank,” said Investors

Board Chairman Bill Censky. “I am

convinced that he can significantly

contribute to the further growth of

our banking business.”

Schneider has 25 years of banking

experience in a variety of areas and

is a former chairman of the Wiscon-

sin Business Development Finance

Corporation. He holds a BBA from

the University of Wisconsin-River

Falls and graduated from the Graduate

School of Banking in Madison.

Tim Schneider

WBD works with lending partners

like you to provide fixed rate

financing and help hundreds of

small businesses each year fund

growth and cultivate success.

| 800.536.6799

Dan Holum

Victor Schultz