24

Wisconsin Community Banker

January/February 2014

End of an Era: Wick Family Sells Bank of Turtle Lake to

Dairy State Bank

Doris Green

W

hen the Wick family sold

the Bank of Turtle Lake

early this year, it marked the end

of their combined 143 years of

small-town customer service.

Beginning with their grandfather,

Ernie Wick, the family has been

associated with the bank since

the height of World War II. For

possibly the first time in 70 years,

a Wick did not sign the latest

call report. The bank opened its

Island City Branch in Cumber-

land in 1991.

The Bank of Turtle Lake

incorporated much earlier,

on March 17, 1900 in a small

wooden structure south of the

present-day Turtle Lake Pub-

lic Library. The bank erected a

new facility in 1902. When the bank

opened, the surrounding land was

largely cutover timber. Slowly, farm-

ing replaced lumber and sawmill

operations as the major occupation

of the region and land prices rose

steeply during World War I. In 1922

bank deposits totaled approximately

$250,000. The bank survived the Great

Depression and became a member of

the FDIC on Feb. 1, 1934.

In 1944, the Bank of Turtle Lake

was purchased by stockholders of

Northwestern Bank of Cumberland.

Arthur Quinn was named president,

and Ernie Wick, previously with

Northwestern, became cashier. Depos-

its exceeded $1 million in July 1946.

Following Ernie Wick’s death in

1952, his son, Donald, succeeded

him. Don Wick and his sister Dorothy

Cornwall bought out other sharehold-

ers near the end of that year and Don

Wick was named president and cashier

in January 1953. Cornwall became a

director, serving 43 years and retiring

in 1996.

In 1967 the bank moved from a

longtime location on South Maple

Street to a new facility down the street.

With two additions to the bank and

drive-up lanes, this facility remained

the bank’s home until its sale in January.

Four of Don Wick’s six children

eventually joined him in the bank. Pat

began in 1972 and served as president.

Mark followed him into the bank in

1976. Jim entered the business in 1981

and Paul followed in 1982. Mary and

Paul worked for a short period at the

bank before following other career

paths. Don Wick retired in 1989.

Pat Wick noted how the business of

banking has changed since the 1970s,

when a note comprised only two

sheets of paper—the note itself and

a second for collateral. Today, a real

estate loan can comprise 20 forms.

“Being a banker is kind of dream

related. The dreams were making busi-

nesses, autos, and homes become a

reality. Today those dreams are taking

place inside of a cloud of regulations,”

he told a reporter fromThe Times,

Turtle Lake (published Dec. 12, 2013).

“I loved being a small town banker,”

Pat Wick wrote in an e-mail to Wis-

consin Community Banker. “I was able

for a time to share the joys and sadness

of many of my customers. I would say,

the first 32 years were satisfying com-

munity banking. The last 10 years have

[brought] more legislation, regulation,

and enforcement [and meant less time

for] the needs of customers of small

towns. Going forward I will not miss

the endless paper work. …

“Plans are to continue to be friends

with my customers, lower my average

golf score, treat my wife like a queen,

and be a more active father to my

son and daughter.” Wick also plans to

spend more time with his 16-month-

old granddaughter Lana. He con-

cluded, “Banking was a wonderful

career of one person helping to shape

the lives of many others.”

The Bank of Turtle Lake officially

reopened as a branch of Dairy State

Bank on Feb. 24, 2014.

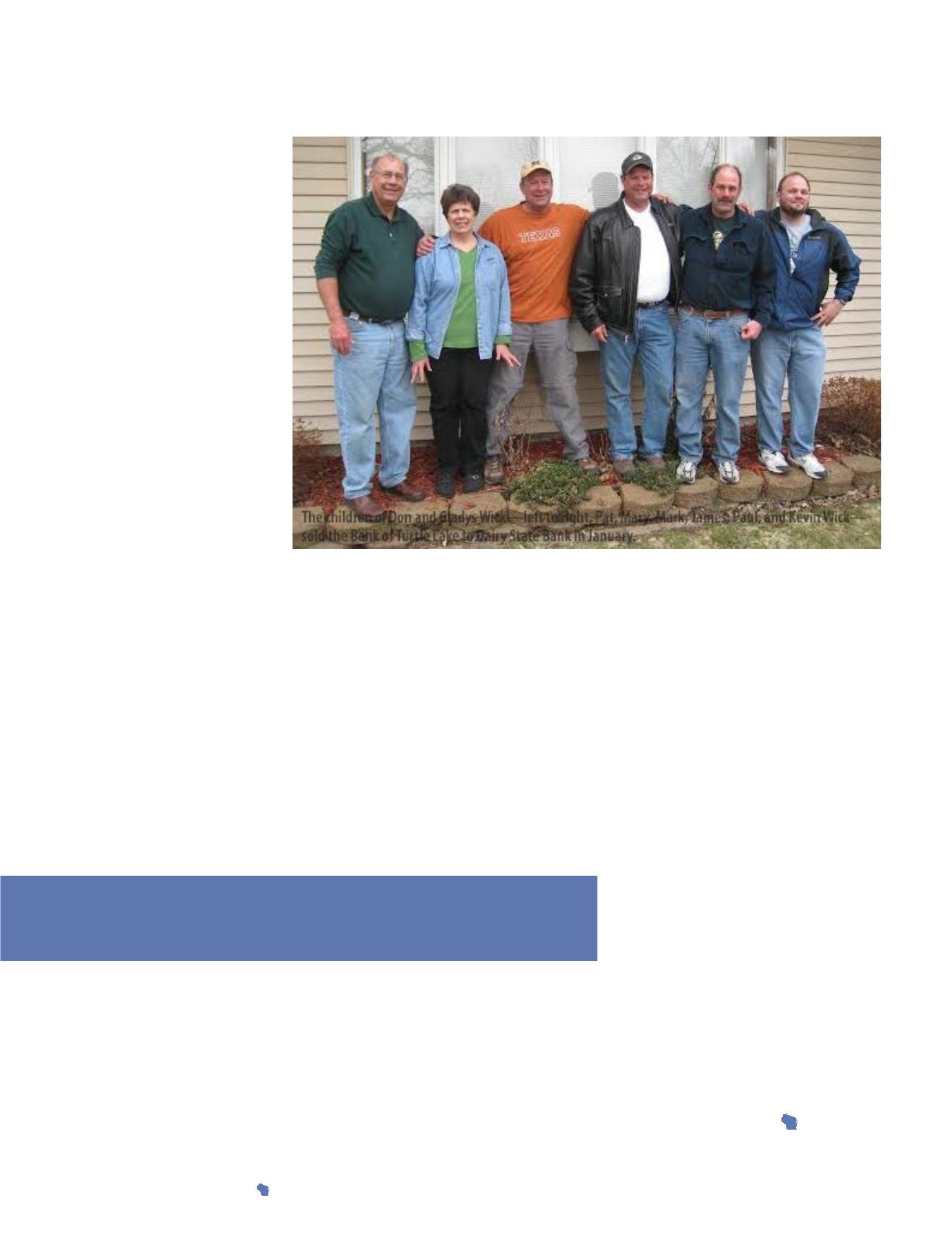

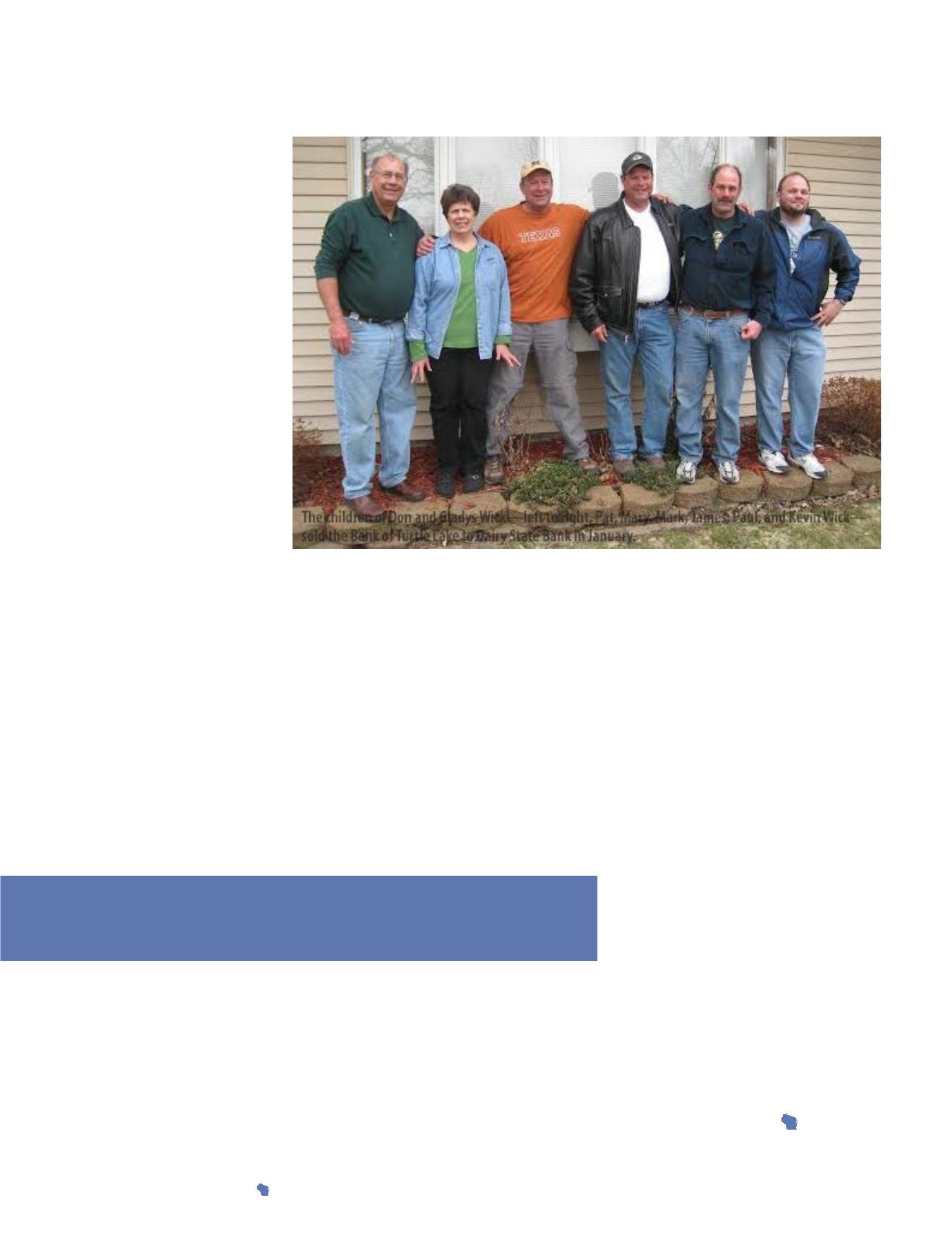

A family affair: four of DonWick’s six children made the

community bank their career.

The children of Don and Gladys Wick—left to right, Pat, Mary, Mark, James, Paul, and KevinWick—

sold the Bank of Turtle Lake to Dairy State Bank in January.