Interior Remodel Results in More Efficient Use of Space

Mary Lou Santovec

W

ouldn’t it be wonderful if when

business needs change, your

workplace environment could change

with it? In their recent remodel,

Cleveland State Bank did just that.

“They had a facility that really had

been involved in serving a different

kind of need,” said Jim Fryk, chief

operating officer with La Macchia

Group, the Milwaukee-based firm that

handled the bank’s remodel.

The slightly over 9,000-square-foot

building was constructed in 1988 with

space for check processing, printing,

and binding, none of which the bank

was currently doing. “The loan admin-

istration area of the bank was spilling

out into our lobby area and we had

concerns with disruption of staff and

potential privacy issues,” said Timothy

Schueler, president and CEO of the

bank explaining the decision behind

the remodel.

The existing combination of

cramped quarters and empty open

spaces was reconfigured in

a three-step process—with

the bank remaining open

all the while. “Based upon

the bank’s advances over the

25 years, 30 percent of the

bank’s interior was devoted

to storage,” said Schueler.

“With the technology

advances over the 25 years,

we were able to more fully

utilize this square footage

to house the growing staff

in the areas of loan admin-

istration, compliance, and

employee training areas.”

The reconfiguration

allowed staff to be grouped

by department, not accord-

ing to which offices might

be open at any given time.

Customer service employees

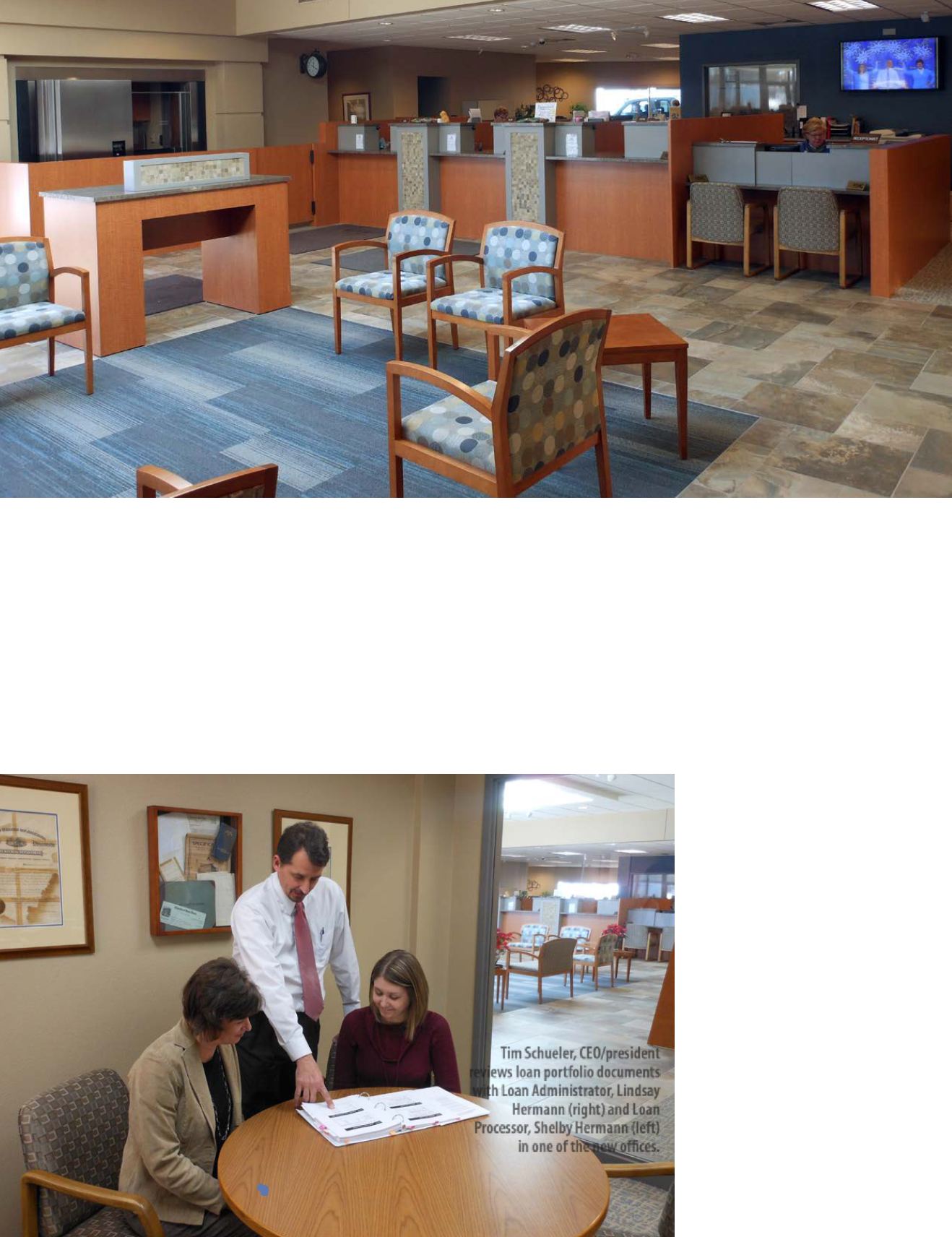

Tim Schueler, CEO/president

reviews loan portfolio documents

with Loan Administrator, Lindsay

Hermann (right) and Loan

Processor, Shelby Hermann (left)

in one of the new offices.

22

Wisconsin Community Banker

January/February 2014