8

Wisconsin Community Banker

March/April 2014

Wisconsin Agriculture:

Good Balance Sheets, Strong Earnings

Mary Lou Santovec

W

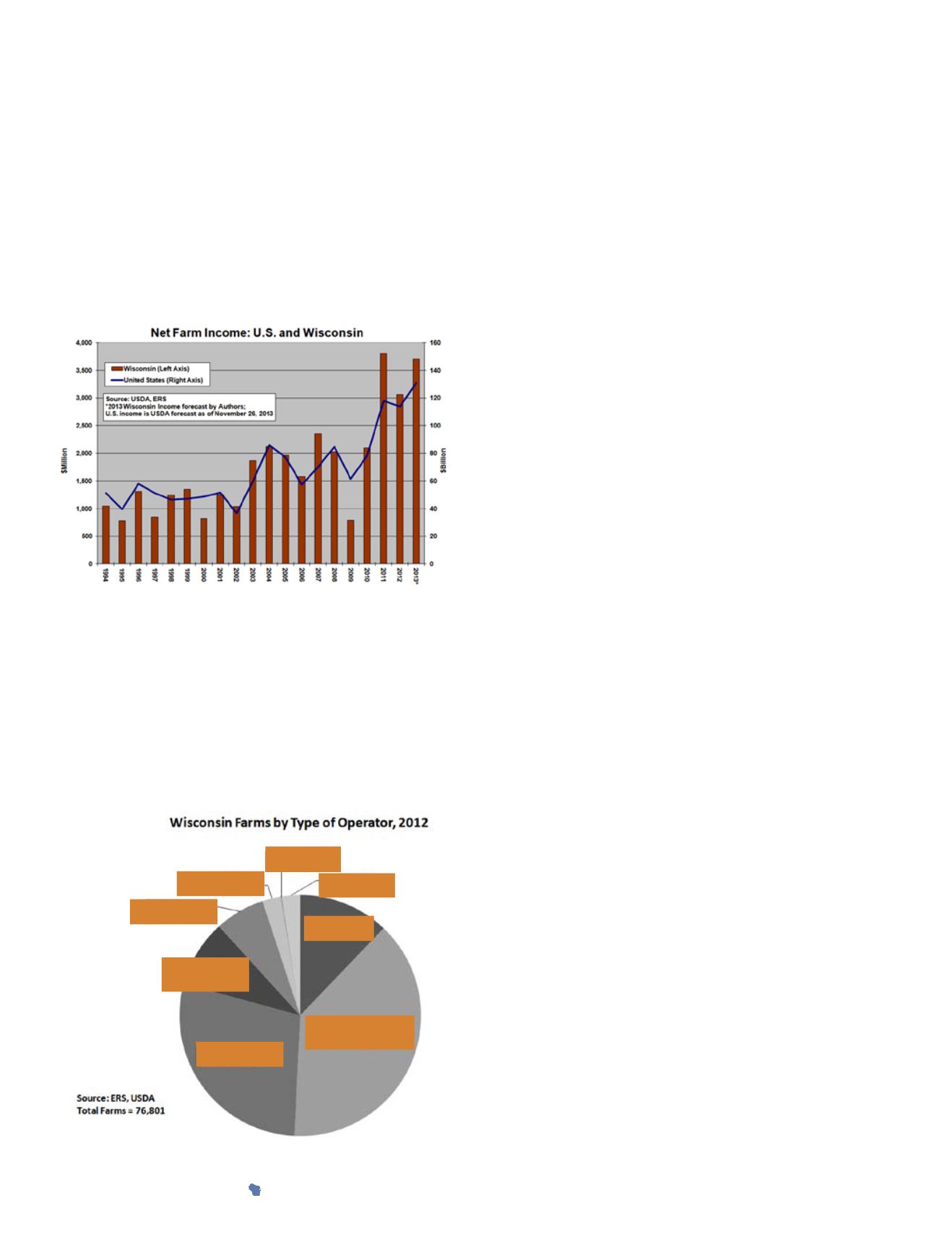

isconsin farmers experienced a silver lining in the

stormy economic clouds of 2013. According to

the annual Status of Wisconsin Agriculture report from

the University of Wisconsin-Madison’s Agricultural and

Applied Economics Department, the state’s net farm income

increased by some 14 percent to $3.75 billion.

“The agricultural economy is on the upswing,” said Rick

Klemme, dean, UW-Cooperative Extension. Klemme made

his remarks at the annual Wisconsin Agricultural Economic

Outlook Forum held early this year at UW-Madison.

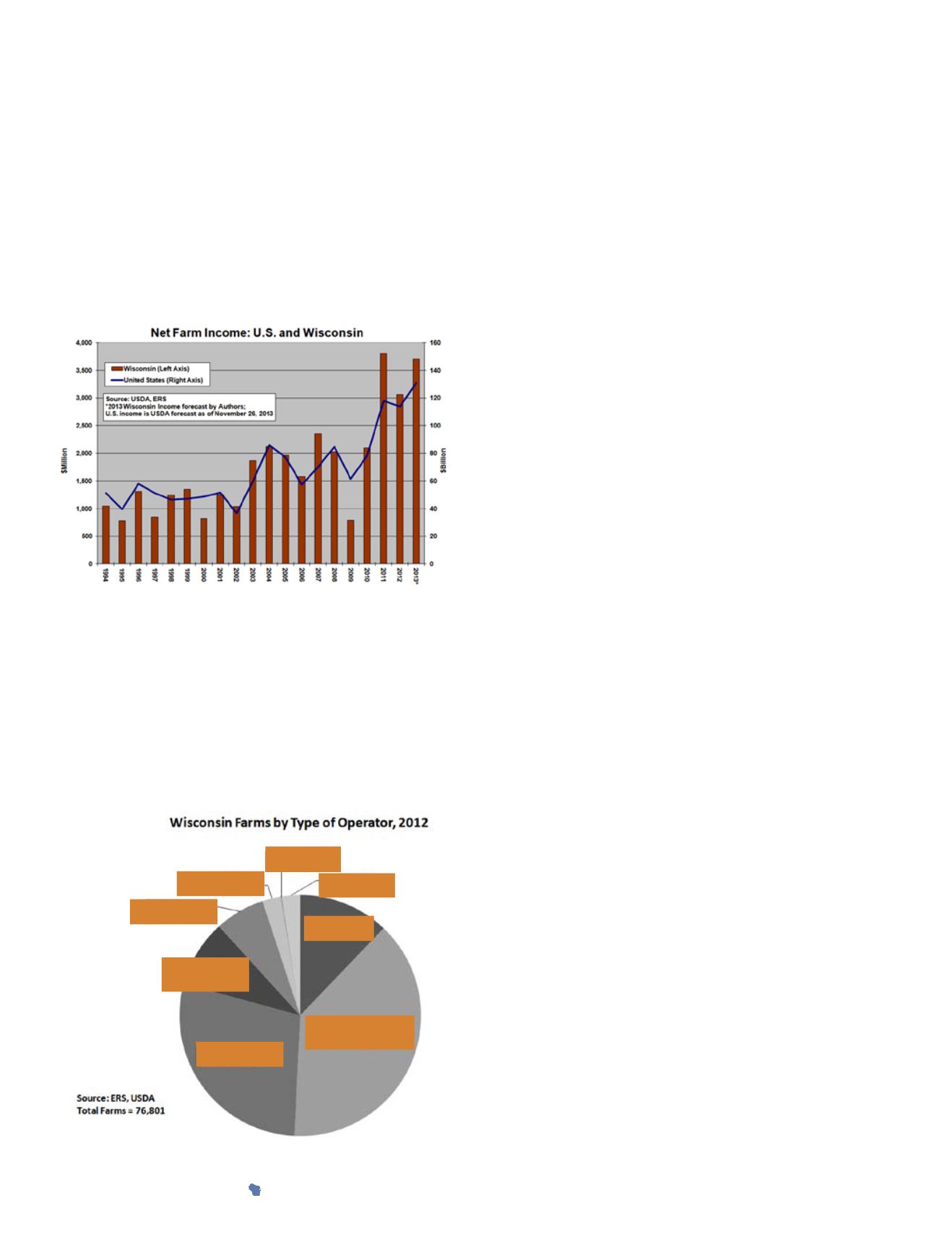

The number of farms remains stable at 76,800 (approxi-

mately 10,500 are dairy) from a high of 200,000 in 1940.

Most are considered low sales (less than $150,000 in gross

income), off-farm occupation farms (operators who report

farming isn’t their primary occupation), and retirement

farms (where operators report being retired).

Other statistics: The average farm measured 195 acres. In

2012, the average age of the Wisconsin farmer was 56.

In a “renaissance of the dairy industry” last year, the all-

milk price was $20.25 a hundredweight, remarkable given

the rest of the economy’s sluggish recovery, Klemme said.

Milk production set a new high of 27.7 billion pounds.

Diversity within the industry helps even out the peaks

and valleys of volatile milk prices and leads to “very strong

earnings reaped by Wisconsin farmers,” said Bruce Jones,

professor of agricultural and applied economics.

Record earnings over the past three years have resulted

in a stronger collective balance sheet. In 2012, the debt-to-

asset ratio was 13 cents per dollar while in 2013 it was 11

cents. Assets have increased $12 billion over the past five

years.

Farmers are “taking their earnings and retiring debt,”

Jones said. Mortgage debt declined some $600 million from

2011 to 2012 while the value of farmland and buildings

grew more than $2 billion during that same time.

US Economy

The Federal Reserve’s monetary policy impacts domestic

food demand and agricultural exports. It’s also kept com-

modity prices down.

Unemployment and the labor force will influence future

growth of the nation’s economy. “Unemployment has not

been shared equally across the economy,” Jones said. Unem-

ployment has hit college graduates seeking jobs harder as

more people 55 and older are staying in the workforce.

The United States is still running a negative trade imbal-

ance. The value of the dollar against its trading partners

hasn’t risen but is holding steady. Fortunately there’s been

no slippage in agricultural exports.

With a favorable exchange rate, foreign consumers

bought a record $140.9 billion of agricultural exports. Most

exports headed to Mexico, Canada, and Asia.

Farm Inputs

The price of fertilizer, feed, and fuel are about the same

as they were in 2012. Cash rents remain high although fuel

prices are down.

For 2014, the outlook on farm input prices is mixed.

Corn and soybeans will register lower prices. Energy inputs

such as gas, diesel, and propane will be driven by crude oil

prices and the extraordinarily long, cold winter. Costs for

capital equipment and labor are going up.

Interest rates are hovering around 5 percent. Loan

demand has seen a steady decline while repayments have

been up since 2010.

>>>

Mid-size Family Farms

6.7%

Large Farms

2.4%

Very Large Farms

0.2%

Non- Family Farms

2.4%

Retirement Farms

12.1%

Off-Farm Occupation Farms

38.6%

Farming: Low Sales

28.5%

Farming: Moderate

Sales

9.0%