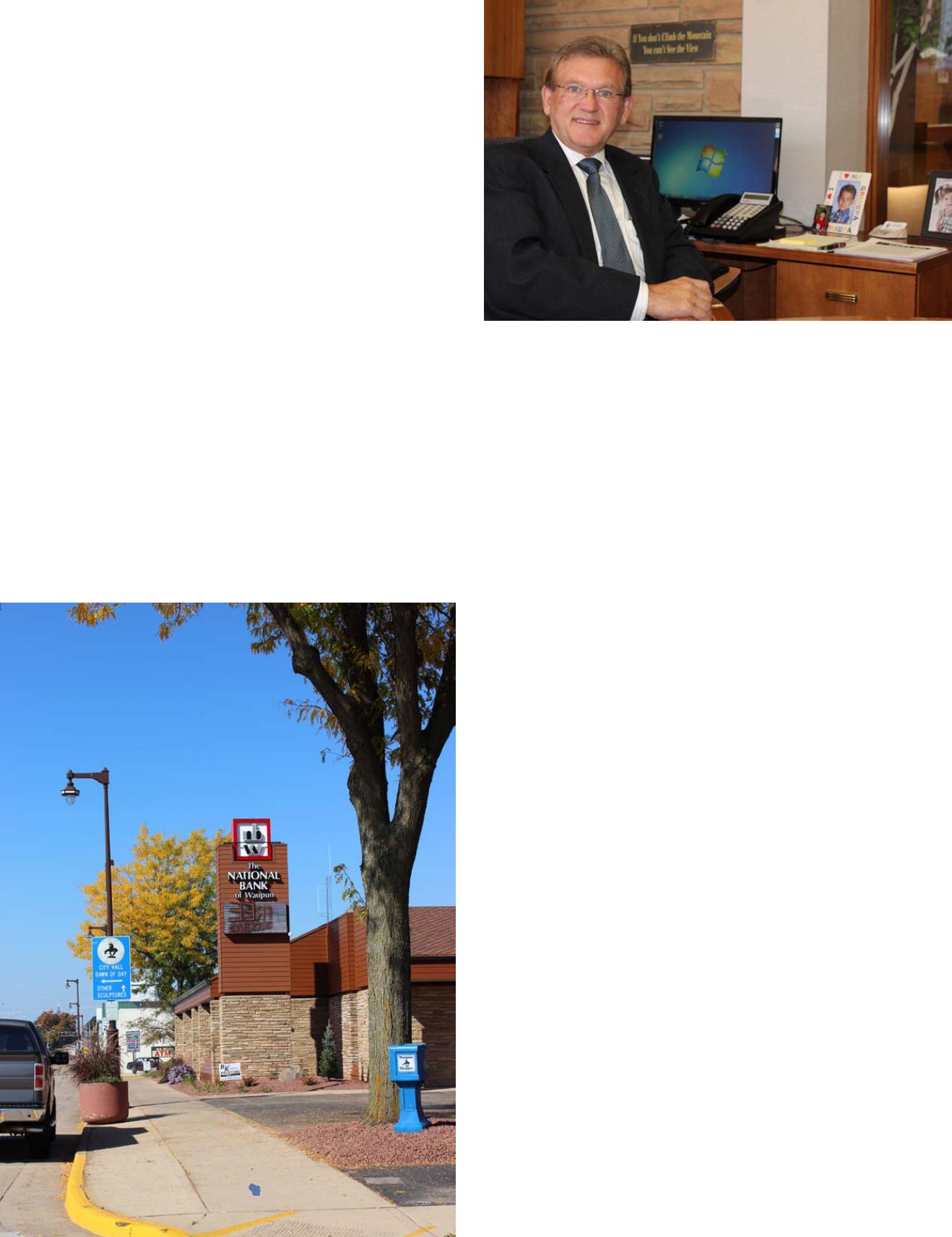

Jerry O’Connor, New CBW

Chairman: Incumbent on

All to Be Engaged

Mary Lou Santovec

T

he third of Sir Isaac Newton’s laws of motion states

that for every action there is an equal and opposite

reaction. Jerry O’Connor appears to intuitively understand

that law. He strives to live his life to maximize any positive

actions and thus avoids many negative reactions or

“consequences.”

O’Connor, CEO and board chairman at The National

Bank of Waupun and the new CBW chairman, grew up in

Lone Rock. One of seven boys, O’Connor and his family

moved to Madison where he graduated from Madison West

High School.

Rather than studying for a business degree like many

bankers, O’Connor went to Minnesota Bible College in

Rochester, Minn., where he majored in pastoral studies with

the consideration of being a pastor. He hasn’t fully left that

initial career choice behind.

Every Sunday, O’Connor preaches at a church in Wiscon-

sin Dells where he and his wife, Amy, own a vacation home.

“While this [preaching] remains a keen interest in my

life, I have found my talents and passions have fit equally

well in my role as a community banker,” O’Connor said.

When asked why he’s not working full time in ministry, he

quipped: “Gee, I thought I was.

“The principles still stand up whether you’re a preacher

or doing something else.”

Strong Family Ties

Besides his six brothers, O’Connor credits his father, who

lost his eyesight by age 40, as being an influential mentor.

“The defining issue for my dad was not that he lost his eye-

sight; it was his commitment to overcoming it.”

His father had owned a small Chevrolet dealership. When

his eyesight failed, he became the first blind person to be

licensed as a mortgage banker, real estate broker, and insur-

ance agent, all of which set the stage for his sons’ careers.

O’Connor’s brother, Tom, is president of TSB Bank in

Lomira and Terry is a senior commercial lender for Horicon

Bank. John serves as president of Madison’s Velcor Leasing

and Pat is a real estate developer. Jim followed his dad into

the car business as a dealer and Dan retired as a professor.

Jerry O’Connor began his career working in mortgage

banking with his father, helping him place large agricultural

and commercial real estate mortgages with insurance com-

panies. He moved from mortgage banking to work for the

Farm Credit Bank of St. Paul in their Fond du Lac office for

13 years. He later served as branch manager for M&I Bank.

His experiences all have one thing in common: “the lending

principles are the same.”

O’Connor joined The National Bank of Waupun as its

chief credit officer in 1988 and was promoted to CEO and

chairman of the board in 2007. Originally a private bank

chartered in 1876, The National Bank of Waupun received a

national charter in 1885 as The First National Bank of Wau-

pun. In 1905, with $60,000, shareholders reorganized the

charter as The National Bank of Waupun.

The bank has assets of $140 million, $125 million in

deposits, a $90 million loan portfolio, and a $34 million

investment portfolio. There are four locations in Waupun,

Brandon, Rosendale, and Fairwater and 33 “exceptional

employees.”

In addition to mentoring the O’Connor boys, “Dad …

challenged us to a level [of perseverance] where it would

never be asked, ‘And what is your excuse for not being able

8

Wisconsin Community Banker

September/October 2014